Are Social Security Payments Taxed

Are Social Security Payments Taxed - Are social security benefits taxable youtube. Should you file income taxes if you receive social security benefits Social security payment schedule 2023 trading bees

Are Social Security Payments Taxed

Supplemental Security Income SSI is never taxable If you do have to pay taxes on your benefits you have a choice as to how You can file quarterly estimated tax returns with the IRS or ask Social Security to withhold federal taxes from your benefit payment SAVE MONEY WITH THESE LIMITED TIME OFFERS The Social Security Administration estimates that 40% of recipients pay income tax on their benefits. The taxable benefits include retirement and spousal, survivor, and disability (SSDI) benefits.

Are Social Security Benefits Taxable YouTube

Are Social Security Payments Taxable WalletGenius

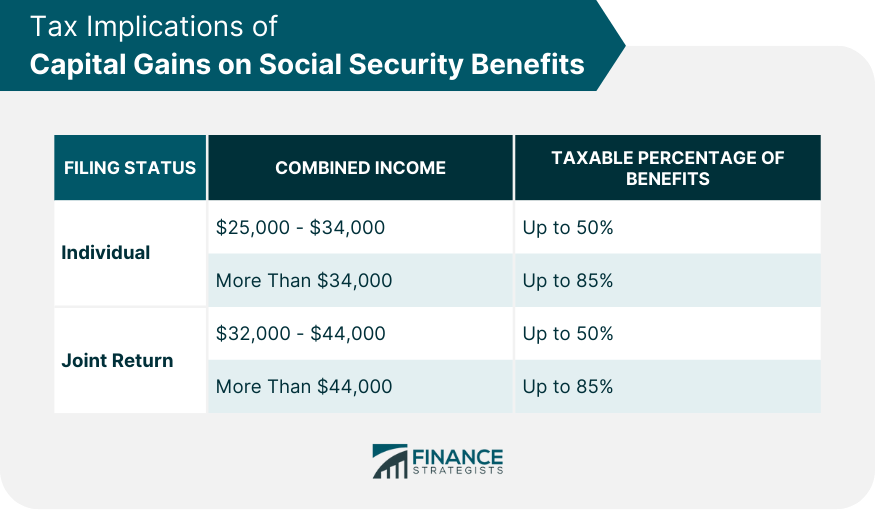

Are Social Security Payments TaxedYou will pay tax on your Social Security benefits based on Internal Revenue Service (IRS) rules if you: File a federal tax return as an "individual" and your combined income* is. Between $25,000 and $34,000, you may have to pay. If you file your income tax return as an individual with a total income that s less than 25 000 you won t have to pay taxes on your Social Security benefits Single filers with a combined income of 25 000 to 34 000 must pay income taxes on up to 50 of their Social Security benefits

Gallery for Are Social Security Payments Taxed

Are Social Security Payments Taxed Is Social Security Taxed Like

Should You File Income Taxes If You Receive Social Security Benefits

Are Social Security Benefits Taxed As Income Senior Security Alliance

/GettyImages-144560286-577404875f9b5858752b6d6d-1a80d8ccaca4477c86b8b840a36f8868.jpg)

Social Security Payment Schedule 2023 Trading Bees

Why Are Social Security Benefits Taxable The Motley Fool

How Is Social Security Income Taxed

How Is Social Security Taxed How Much Of Your Social Security Income

Are Taxes Deducted From Social Security Benefits

Social Security Tax Calculator 2025 Sandy Rozelle

Impact Of Capital Gains And Social Security Finance Strategists