Form 1041 Schedule D

Form 1041 Schedule D - Form 1041 schedule d capital gains and losses 2014 free download. Form 1041 schedule k 1 and form 1041 schedule d main differences Form 1041 schedule d

Form 1041 Schedule D

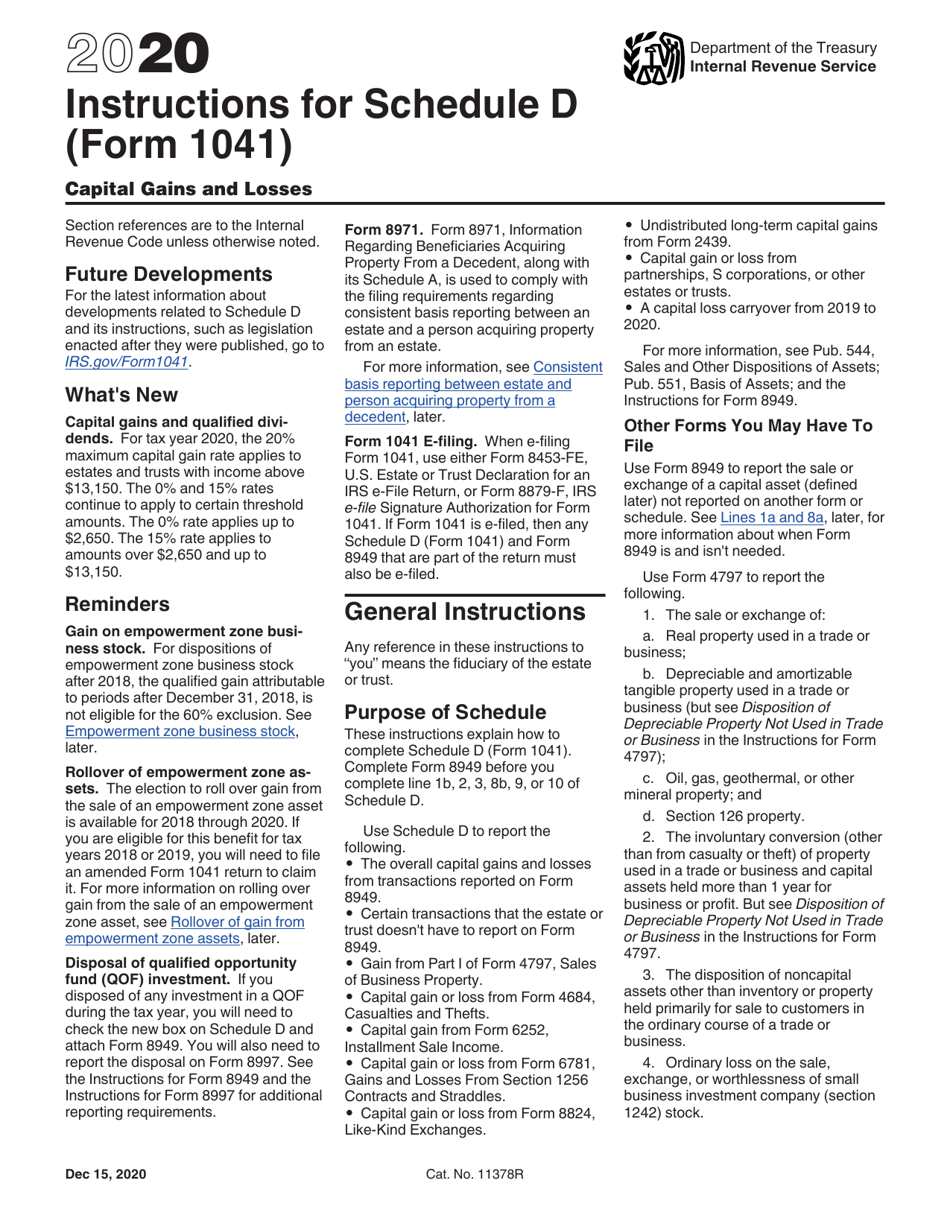

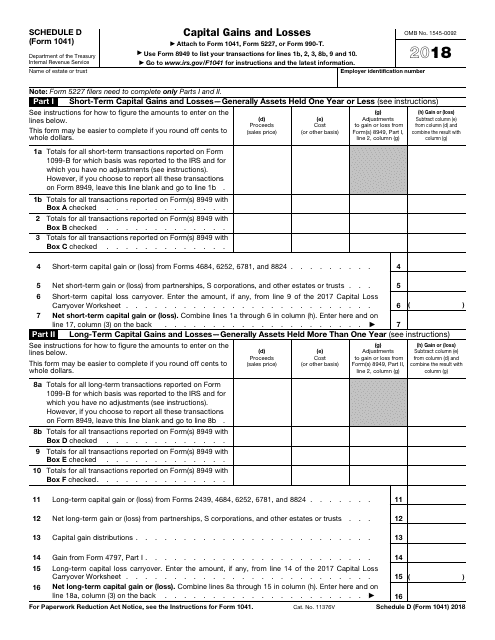

Use Schedule D Form 1041 to report gains and losses from the sale or exchange of capital assets by an estate or trust Schedule D From 1041 PDF Instructions for Schedule D Form 1041 · The Schedule D form is what most people use to report capital gains and losses that result from the sale or trade of certain property during the year. TABLE OF CONTENTS. Schedule D. Capital asset transactions. Short-term gains and losses. Click to expand. Schedule D.

Form 1041 Schedule D Capital Gains And Losses 2014 Free Download

Schedule D 1 Printable Fillable Blank PDF Online IRS Tax Forms

Form 1041 Schedule DUse Form 1041 Schedule D to report gains or losses from capital assets associated with an estate or trust. Form 1041 Schedule D is a supplement to Form 1041. Make sure you are using the correct Schedule D, as there is a schedule D for Form 1040, but they are not interchangeable. These instructions explain how to complete Schedule D Form 1041 Complete Form 8949 before you complete line 1b 2 3 8b 9 or 10 of Schedule D Use Schedule D to report the following The overall capital gains and losses from transactions reported on Form 8949 Certain transactions that the estate or trust doesn t have to report on Form 8949

Gallery for Form 1041 Schedule D

Form 1041 Schedule D Instructions Fill Online Printable Fillable Blank

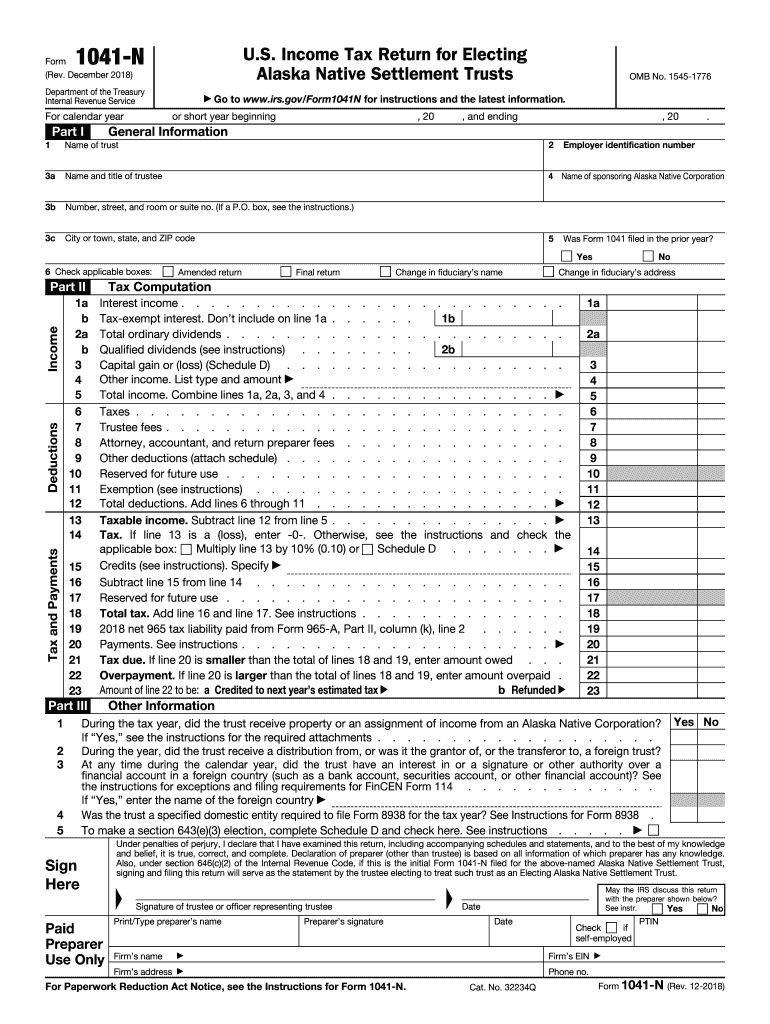

Form 1041 Schedule K 1 And Form 1041 Schedule D Main Differences

Form 1041 Schedule D Capital Gains And Losses

Form 1041 Schedule D

Download Instructions For IRS Form 1041 Schedule D Capital Gains And

IRS Form 1041 Schedule D Download Fillable PDF Or Fill Online Capital

Form 1041 Fill Out And Sign Printable PDF Template SignNow

Irs Form 1041 Schedule B Prosecution2012

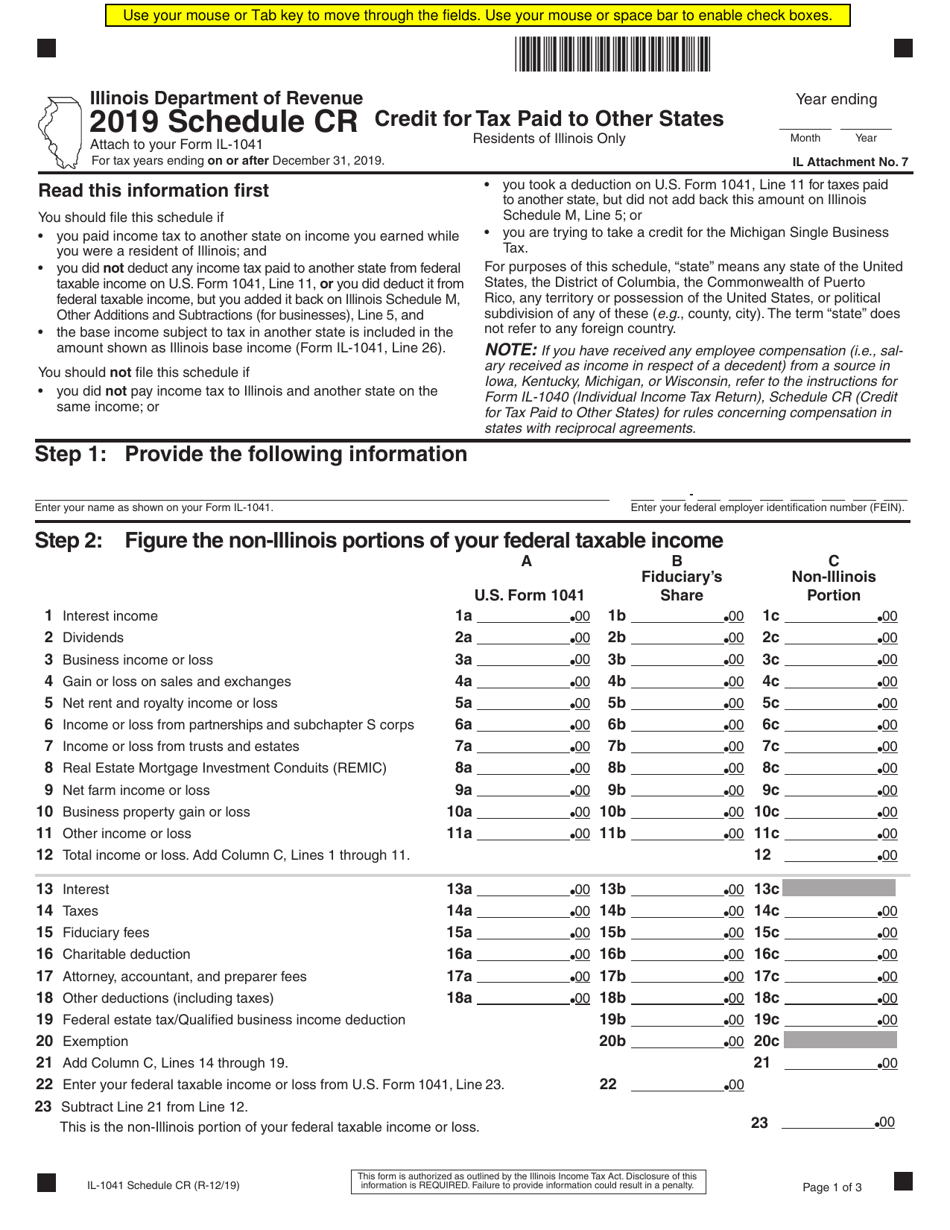

Form IL 1041 Schedule CR Download Fillable PDF Or Fill Online Credit

Best IRS Tax Forms