Form 8962 2024

Form 8962 2024 - Form 8962 edit fill sign online handypdf. Form 8962 fillable form printable forms free online Form 8962 fillable printable forms free online

Form 8962 2024

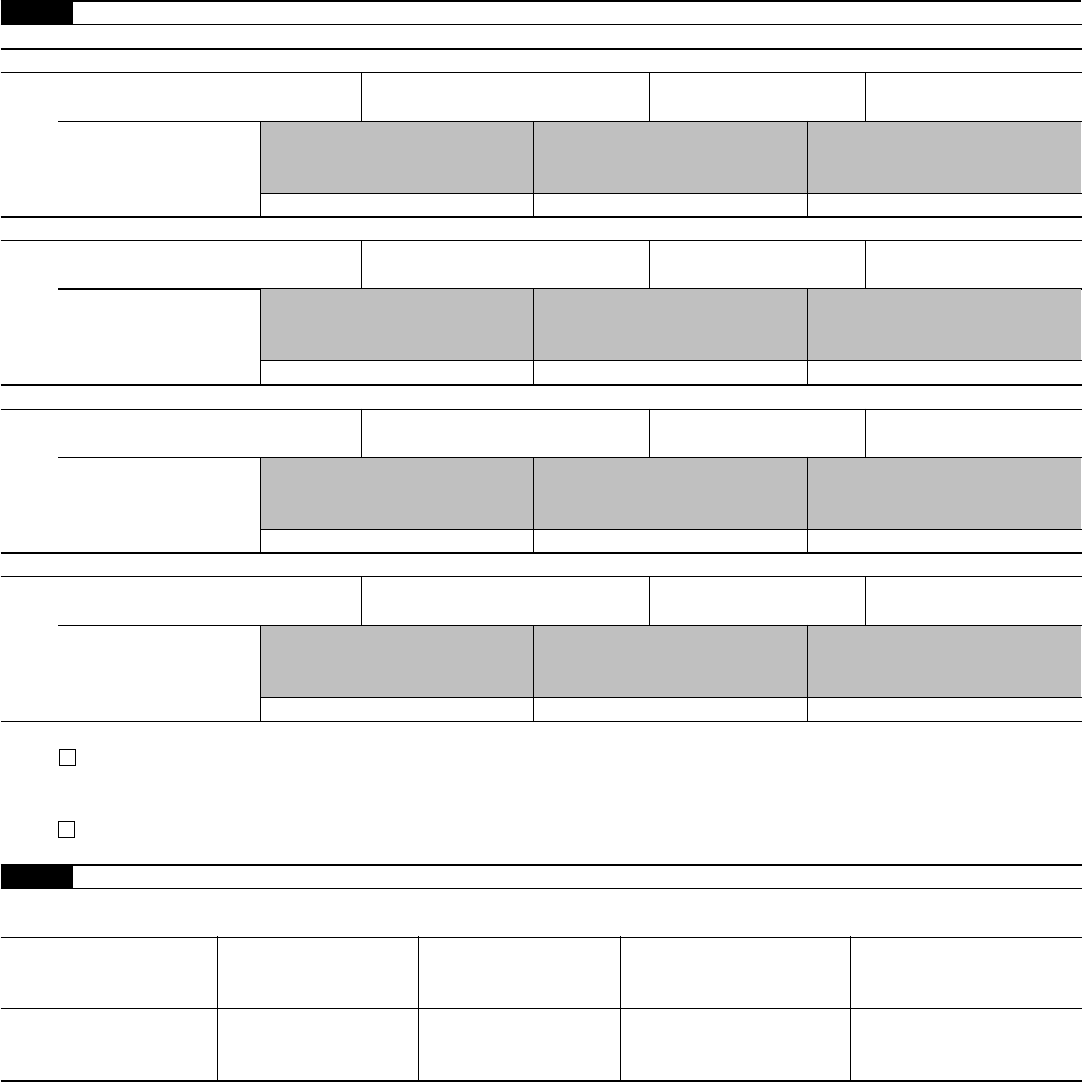

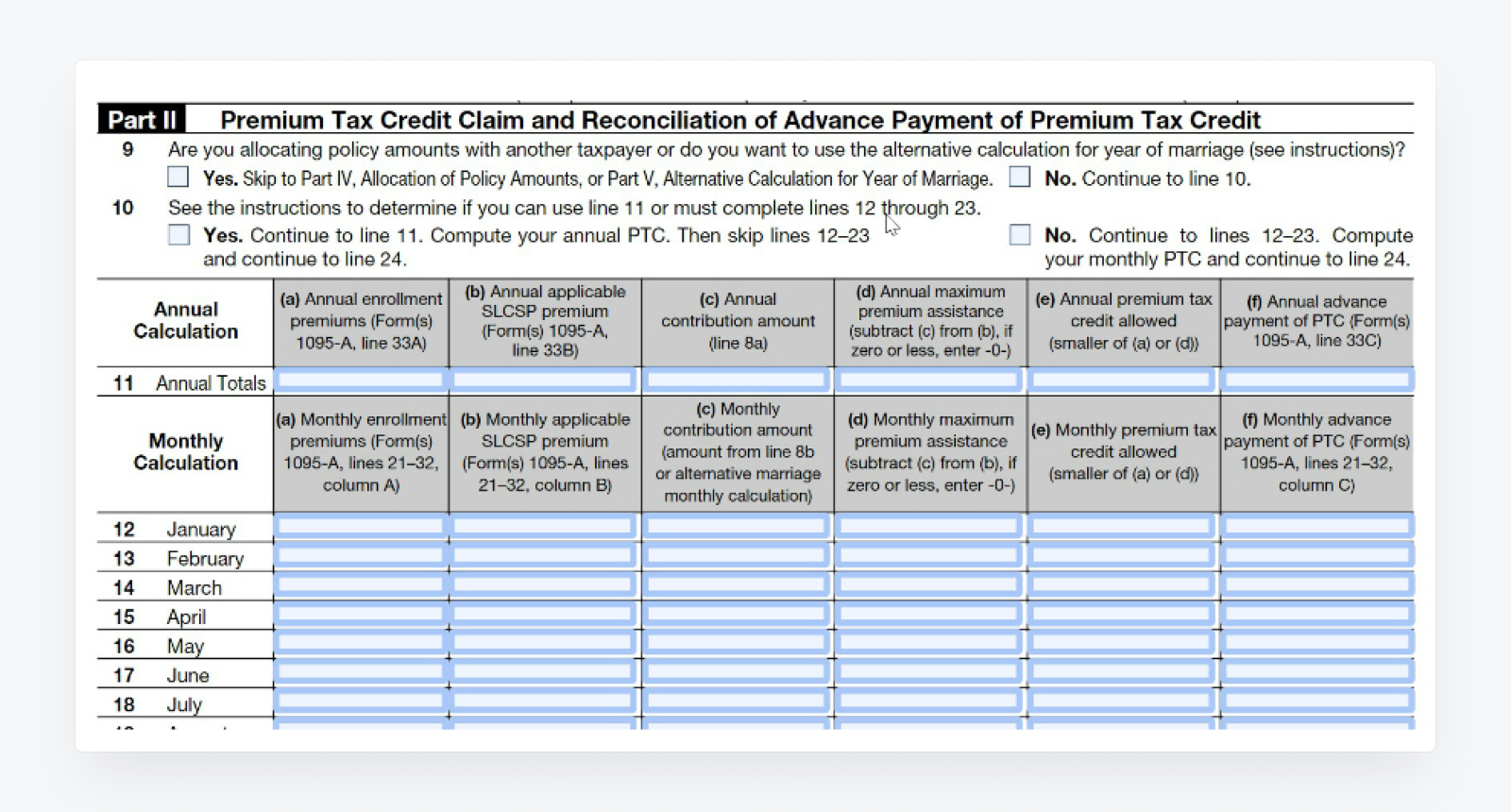

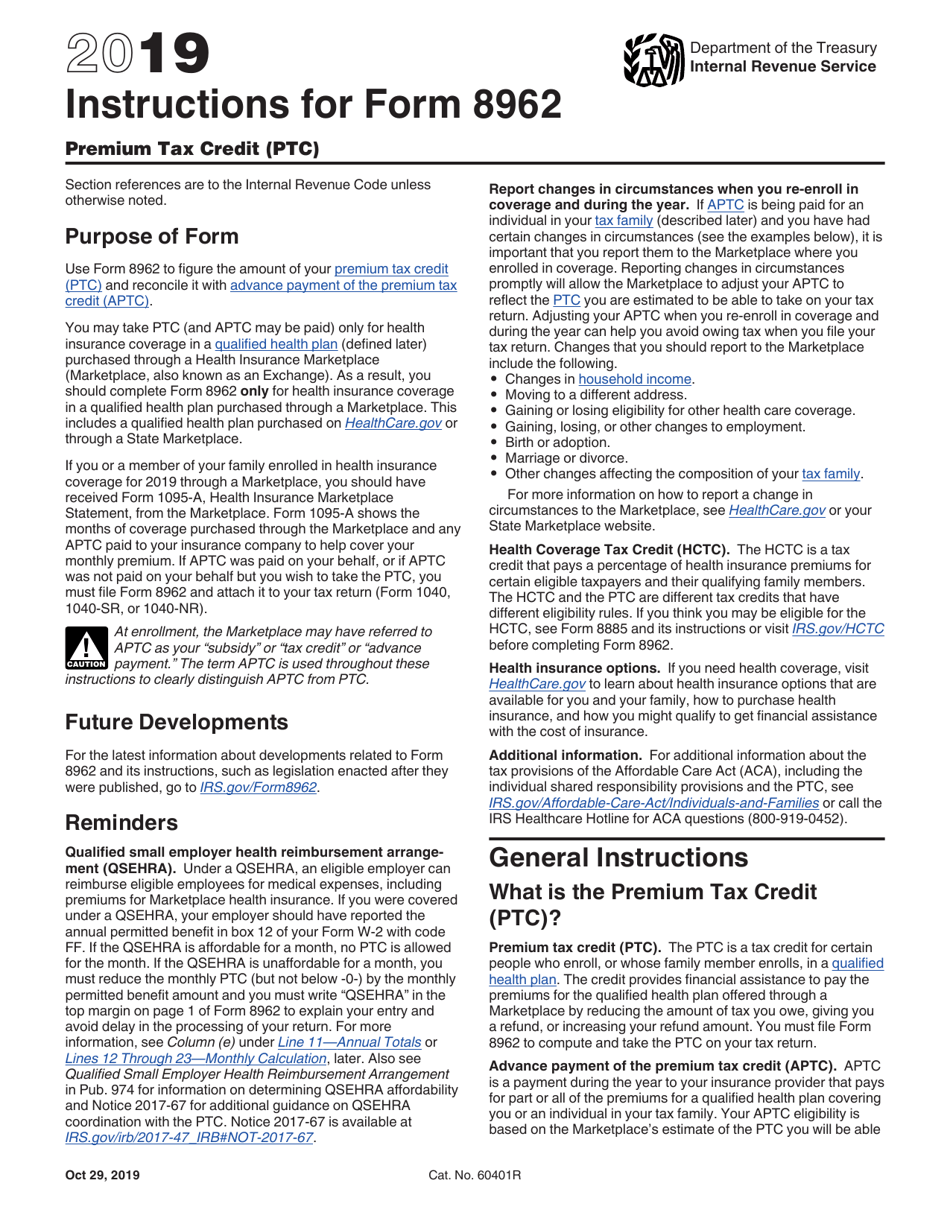

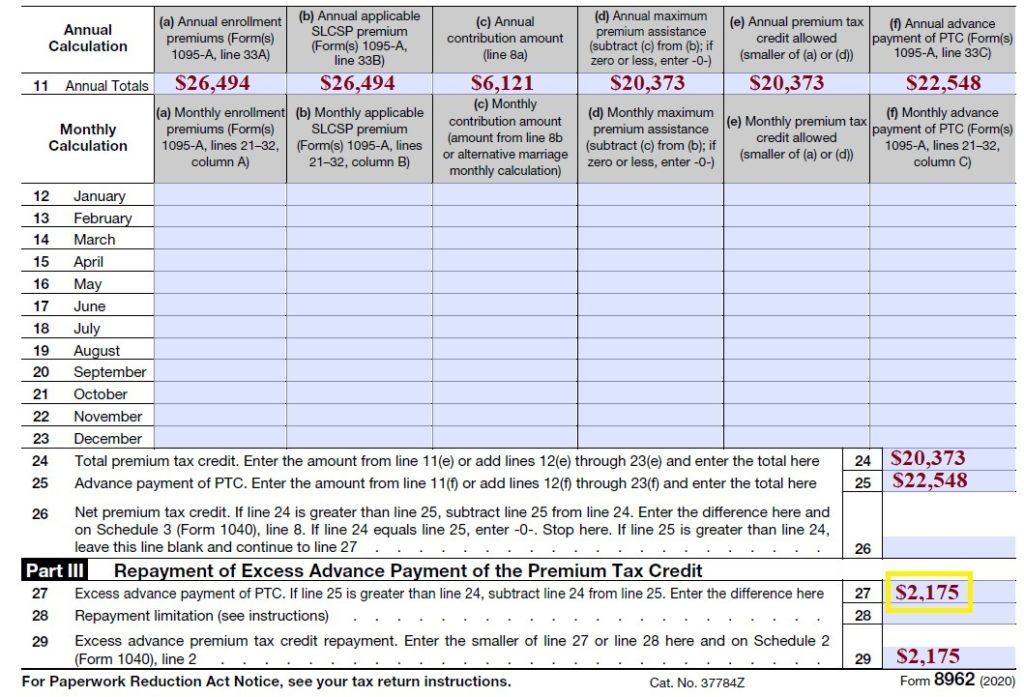

Apply enroll in 2024 coverage today Beat the December 15 deadline to enroll in health coverage that starts January 1 Apply now Form 8962 Premium Tax Credit If you had Marketplace insurance and used premium tax credits to lower your monthly payment you must file this health insurance tax form with your federal income tax return You OVERVIEW The premium tax credit took effect beginning in the 2014 tax year, and provides tax savings to offset the cost of health insurance, for those who qualify. TABLE OF CONTENTS Form 8962 What is the premium tax credit? Eligibility requirements for the premium tax credit Click to expand Key Takeaways

Form 8962 Edit Fill Sign Online Handypdf

Everything You Need To Know About IRS Form 8962 Points North

Form 8962 2024Form 8962 is used to calculate the amount of premium tax credit you're eligible to claim if you paid premiums for health insurance purchased through the Health Insurance Marketplace. Claiming... Apply enroll in 2024 coverage today Beat the December 15 deadline to enroll in health coverage that starts January 1 Apply now You ll use IRS Form 8962 to do this If you used more premium tax credit than you qualify for you ll pay the difference with your federal taxes If you used less you ll get the difference as a credit

Gallery for Form 8962 2024

2016 Form 8962 Edit Fill Sign Online Handypdf

Form 8962 Fillable Form Printable Forms Free Online

Fill Free Fillable Premium Tax Credit PTC Form 8962 PDF Form

Form 8962 Fillable Printable Forms Free Online

Irs Form 8962 Instructions Fill Online Printable Fillable Blank

How To Fill Out Form 8962 Monthly Premium Taxes Instructions PDFliner

IRS Form 8962 Premium Tax Cerdit PTC Blank Lies With Pen And Many Hundred Dollar Bills On

Download Instructions For IRS Form 8962 Premium Tax Credit Ptc PDF 2019 Templateroller

Example Of Form 8962 Filled Out Fasrportland

Health Insurance 1095A Subsidy Flow Through IRS Tax Return