Is Social Security Taxable

Is Social Security Taxable - 8 2023 social security tax limit ideas 2023 gds. Social security and working fidelity Social security tax definition

Is Social Security Taxable

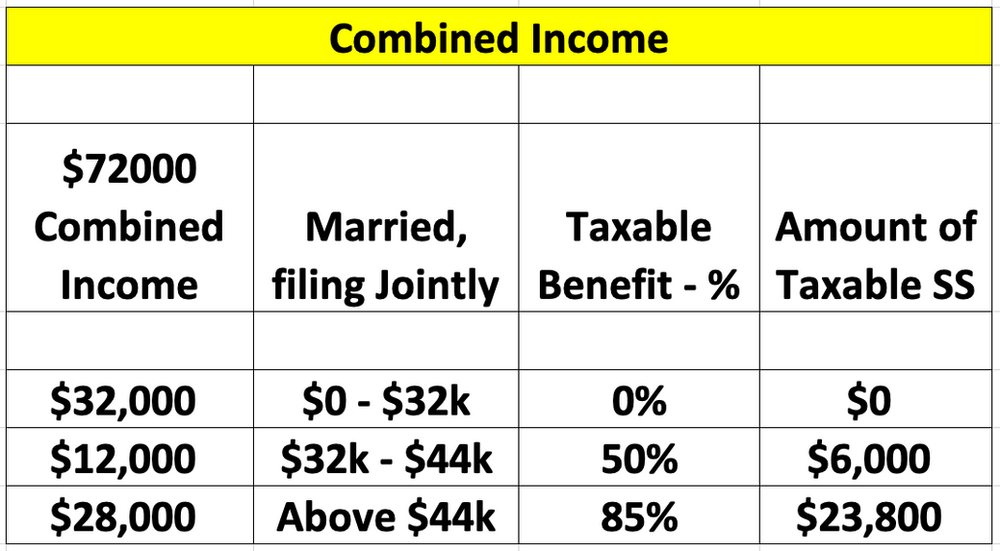

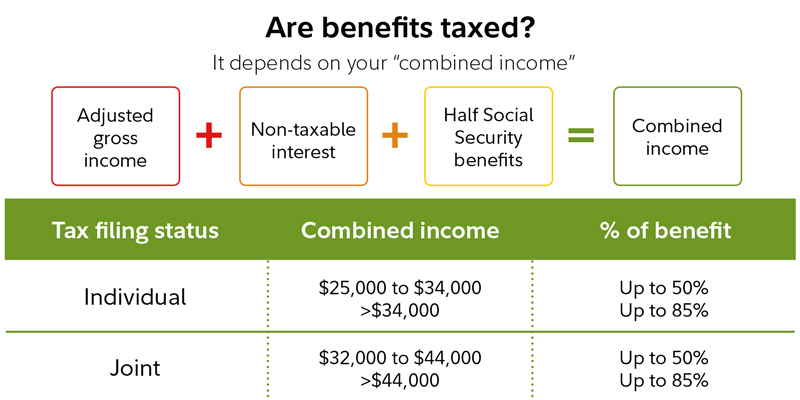

Between 32 000 and 44 000 you may have to pay income tax on up to 50 of your benefits More than 44 000 up to 85 of your benefits may be taxable Are married and file a separate tax return you probably will pay taxes on your benefits Your adjusted gross income Nontaxable interest Are social security survivor benefits for children considered taxable income? I received social security benefits this year that were back benefits for prior years. Do I amend my returns for those prior years? Are the back benefits paid in this year for past years taxable this year? Frequently Asked Question Subcategories for Social Security.

8 2023 Social Security Tax Limit Ideas 2023 GDS

What Is The Taxable Amount On Your Social Security Benefits

Is Social Security TaxableYou would pay taxes on 85 percent of your $18,000 in annual benefits, or $15,300. Nobody pays taxes on more than 85 percent of their Social Security benefits, no matter their income. The Social Security Administration estimates that about 56 percent of Social Security recipients owe income taxes on their benefits. Social Security benefits include monthly retirement survivor and disability benefits They don t include supplemental security income payments which aren t taxable The portion of benefits that are taxable depends on the taxpayer s income and filing status

Gallery for Is Social Security Taxable

Social Security Tax Calculator Are Your Retirement Benefits Taxable

Social Security And Working Fidelity

Retire Ready Are Social Security Benefits Taxed

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

The High Net Worth Guide To Social Security Investopedia

Is Social Security Taxable Income 2021 Maximum Taxable Income Amount

Q A Is My Social Security Income Taxable

Do I Get Taxed On Social Security Income Tax Walls

Is Social Security Taxable YouTube

Resource Taxable Social Security Calculator