What Is Alternative Minimum Tax

What Is Alternative Minimum Tax - What is alternative minimum tax optima tax relief. Tax accounting blog warner tax group certified public accountants Chapter 07 individual amt howard godfrey ph d cpa unc charlotte

What Is Alternative Minimum Tax

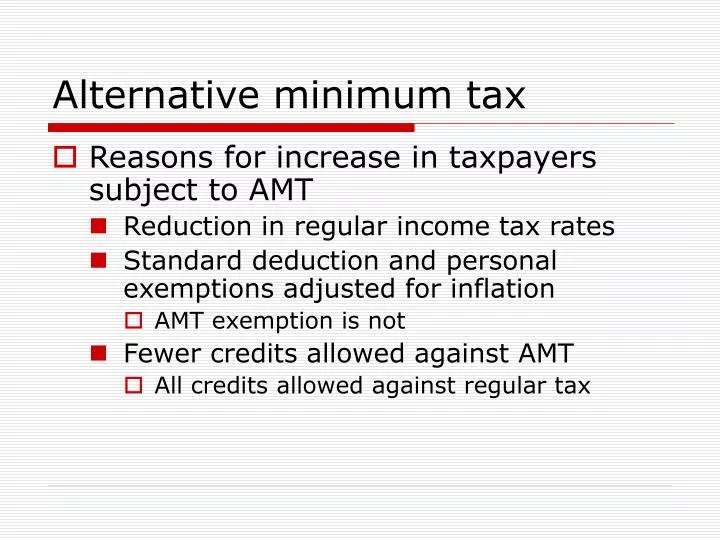

The alternative minimum tax AMT applies to taxpayers with high economic income by setting a limit on those benefits It helps to ensure that those taxpayers pay at least a minimum amount of tax How is the AMT calculated The AMT is the excess of the tentative minimum tax over the regular tax The Alternative Minimum Tax (AMT) was designed to keep wealthy taxpayers from using loopholes to avoid paying taxes. But because it was not automatically updated for inflation, more middle-class taxpayers were getting hit with the AMT each year.

What Is Alternative Minimum Tax Optima Tax Relief

What Is Alternative Minimum Tax AMT Video Fill Out Sign Online

What Is Alternative Minimum Tax. The alternative minimum tax, or AMT, is a different, yet parallel, method to calculate a taxpayer's bill. It applies to people whose income exceeds a certain level and is intended to close... What is alternative minimum tax AMT Alternative minimum tax AMT runs parallel to the standard tax system but it has a different tax rate structure and eliminates some common tax

Gallery for What Is Alternative Minimum Tax

What Is Alternative Minimum Tax How It Affect Higher Earners

Tax Accounting Blog Warner Tax Group Certified Public Accountants

What Is Alternative Minimum Tax AMT In India Meaning Applicability

Chapter 07 Individual AMT Howard Godfrey Ph D CPA UNC Charlotte

The Corporate Taxpayer Ppt Download

.jpg)

Individual Income Tax Computation And Tax Credits Ppt Download

.jpg)

Individual Income Tax Computation And Tax Credits Ppt Download

.jpg)

Individual Income Tax Computation And Tax Credits Ppt Download

Alternative Minimum Tax AMT Definition How It Works Worksheets Library

PPT Alternative Minimum Tax PowerPoint Presentation Free Download